Monthly depreciation calculator

The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above zero appreciation. Monthly depreciation Annual deprecation 12 Monthly depreciation 200 12 1667 Declining balance method As the name states the declining balance method.

How Can I Make A Depreciation Schedule In Excel

The unit used for the period must be the same as the unit used for.

. Depreciation expense is calculated using this formula. Let us try another example as follows for a car. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Monthly depreciation Annual. Syntax DBs syntax is. The MACRS Depreciation Calculator uses the following basic formula.

For example if a cars cost basis is. Multiply the value you get by 2. DB is an Excel function that calculate the depreciation charge in any period directly using the variable declining balance method.

Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Divide 100 by the number of years in your assets useful life. C is the original purchase price or basis of an asset.

The calculator also estimates the first year and the total vehicle depreciation. Our car depreciation calculator uses the following values source. 10 Depreciation Calculator Templates 1.

DB cost salvage life. The syntax is SYD cost salvage life per with per defined as the period to calculate the depreciation. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

Depreciation Amount Asset Value x Annual Percentage Balance. Here are the steps for the double declining balance method. The quotient you get is the SLD rate.

Depreciation Rate 2 x Straight-Line Depreciation Percent Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a full 12. It is fairly simple to use. Select the currency from the drop-down list optional Enter the.

Where Di is the depreciation in year i. The formula for calculating appreciation is as. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

All you need to do is. Cost basis - residual value number of years of the assets expected useful life. Line depreciation calculator exactly as you see it.

After a year your cars value decreases to 81 of the initial value. D i C R i. After two years your cars value.

Annual depreciation Total depreciation Useful lifespan Finally dividing this by 12 will tell you the monthly depreciation for the asset.

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

2

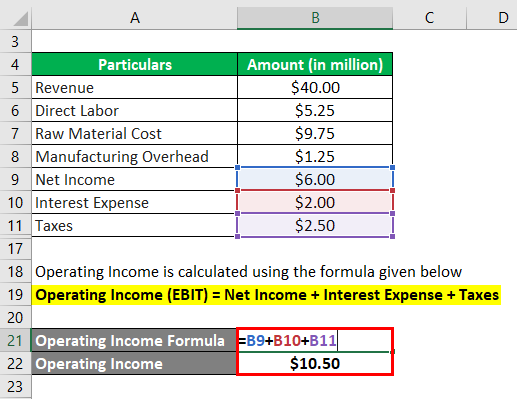

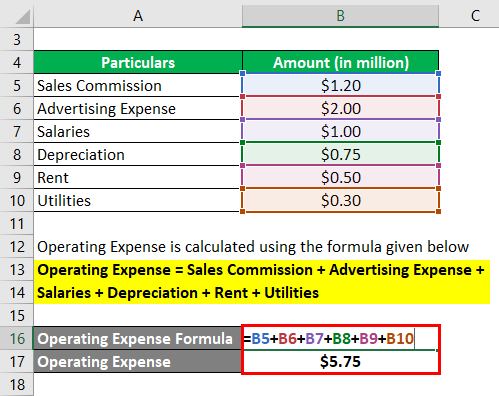

Operating Expense Formula Calculator Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Salvage Value Formula Calculator Excel Template

Free Macrs Depreciation Calculator For Excel

Salvage Value Formula Calculator Excel Template

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

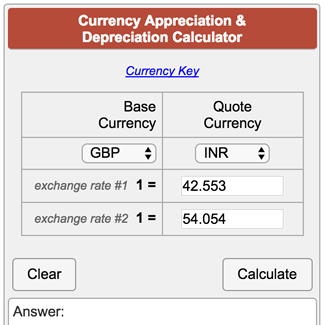

Currency Appreciation And Depreciation Calculator

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Appreciation And Depreciation Calculator Https Salecalc Com Appdep Appreciation Calculator Calculators

Declining Balance Depreciation Calculator

Salvage Value Formula Calculator Excel Template

How To Use The Excel Amorlinc Function Exceljet

Operating Expense Formula Calculator Examples With Excel Template